World News

Economic and Financial News

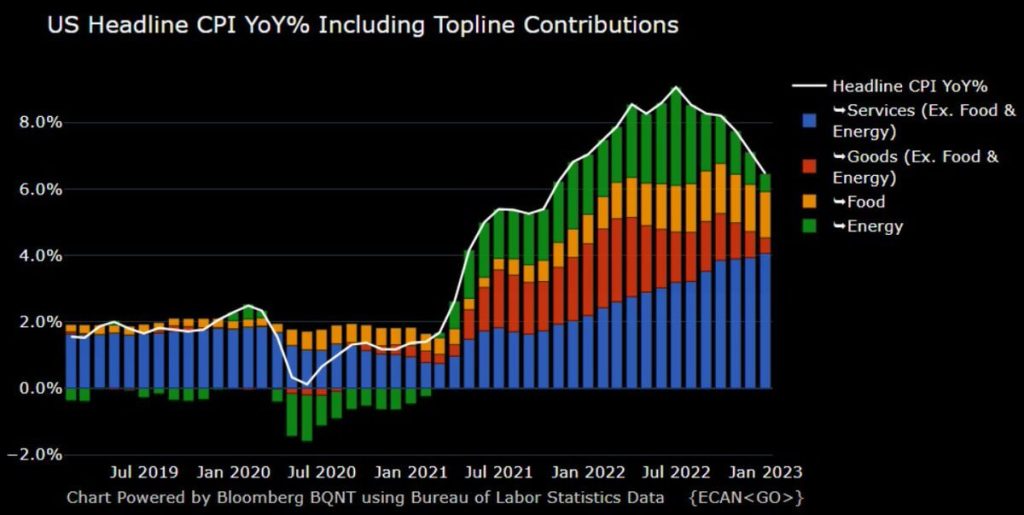

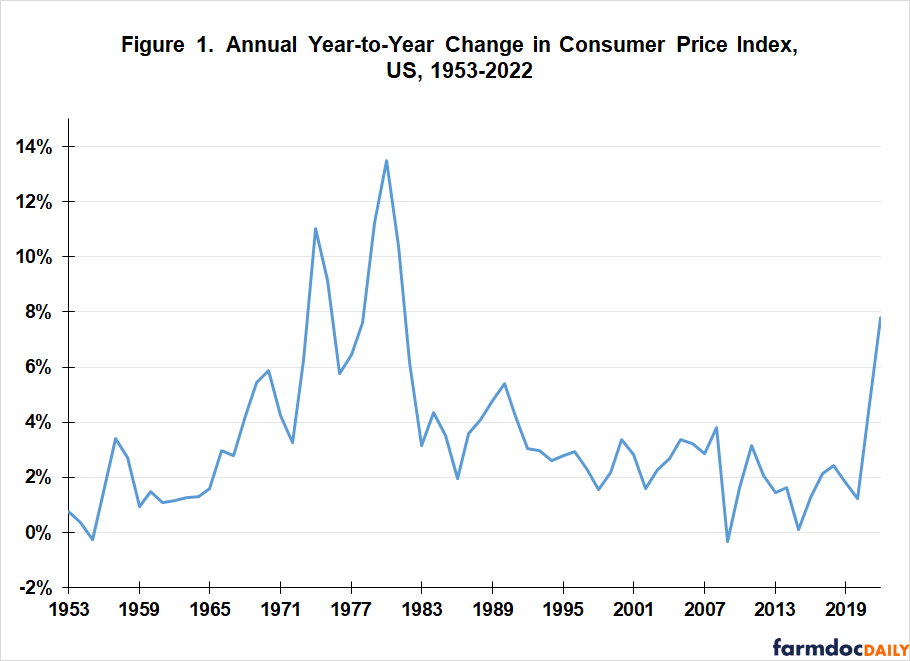

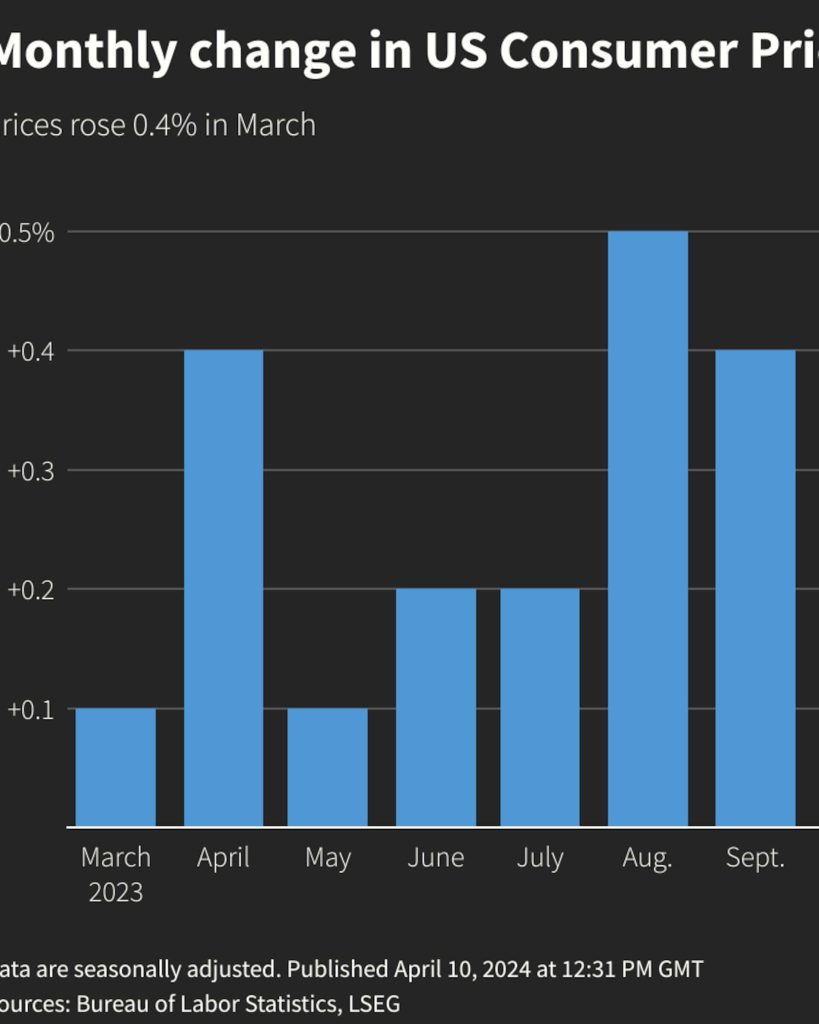

The uptick in inflation rates has been a focal point of concern for many Americans. As per the latest figures from the U.S. Bureau of Labor Statistics, the Consumer Price Index (CPI) climbed by 3.5% in July, marking the highest annual increase since August 2022. The rise is driven primarily by escalating food and energy costs.

Key Highlights

- Employment Report: July’s employment data revealed a mixed bag. On one hand, the unemployment rate held steady at 3.6%, a near 50-year low. However, job creation slowed, with nonfarm payrolls adding only 150,000 jobs, missing economists’ expectations of 185,000.

- Stock Market Performance:

- Dow Jones: Closed at 35,500 points, gaining 0.5% on the day.

- NASDAQ: Ended the day slightly down by 0.2%.

- S&P 500: Managed to eke out a small gain of 0.3%.

- Federal Reserve’s Stance: The Federal Reserve indicated a possibility of another interest rate hike later this year, aiming to curtail inflation. Federal Reserve Chair Jerome Powell emphasized that the central bank is committed to bringing inflation down to its 2% target.

- Oil Prices: Brent crude oil prices surged to $85 per barrel, influenced by geopolitical tensions in the Middle East. Analysts warn this could translate into higher gasoline prices in the coming weeks.

- Cryptocurrency Market: Bitcoin faced a volatile trading session, dropping 5% to settle at $28,000. Analysts indicate this is part of a broader market correction.

Corporate Earnings Reports

- Apple Inc.: Reported quarterly revenue of $90 billion, up 2% year-over-year, but iPhone sales lagged behind expectations.

- Tesla: Surpassed Wall Street estimates with a record-breaking delivery of 466,000 vehicles, attributing success to strong demand for its Model Y.

- Amazon: Posted strong results with net sales of $134 billion, a 9% increase from last year, driven by robust performance in its cloud computing division.

Global Impact

- China’s Economy: China’s economic growth slowed down, expanding at an annual rate of 5.1% in the second quarter, down from 6.3% in the first quarter. The slowdown is attributable to weakened global demand and internal economic policy adjustments.

- European Markets: In Europe, the Eurozone experienced a slight economic contraction of 0.1%, primarily due to lower consumer spending and industrial activity. The European Central Bank has meanwhile decided to keep interest rates unchanged.

These figures paint a mixed yet cautiously optimistic picture of the economic landscape, revealing both opportunities and challenges.

From thedragonfashion